We are giving up this discretion to give an explicit assurance to the markets that we will assist them in the conduct of the borrowing program, said Patra

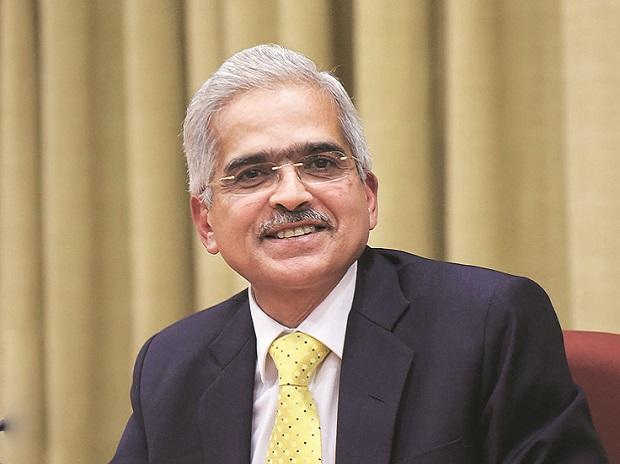

The Monetary Policy Committee (MPC) decided to keep policy rates unchanged in the first bi-monthly monetary policy of 2021-22. Additionally, the Reserve Bank of India (RBI) announced a secondary market G-Sec acquisition programme (G-SAP 1.0), under which the RBI has committed Rs 1 trillion in the first quarter. GOVERNOR SHAKTIKANTA DAS, DEPUTY GOVERNOR MICHAEL DEBABRATA PATRA, DEPUTY GOVERNOR M K JAIN, and EXECUTIVE DIRECTOR T RABI SANKAR took questions from the media. Edited excerpts:

What is the rationale behind G-SAP 1.0?

Das: It is different from the usual open market operation (OMO) calendar. We have given it a distinct character. This programme will run in addition to our normal liquidity adjustment facility (LAF), special OMOs, and other instruments available to us. For the first time, we are giving out a quantum of bond purchase in the secondary market. Earlier, there was a calendar that was given out. But it was not given out for the entire quarter. The signals, communication, and action have to be weighed together.

Patra: It is for the first time the RBI is committing its balance sheet to the conduct of the monetary policy. This has not been done by India before. It is different from OMOs because it gives away discretion. Typically, in an OMO auction, we announce the amount and time. We are giving up this discretion to give an explicit assurance to the markets that we will assist them in the conduct of the borrowing programme. Giving out an amount beforehand also helps market participants plan their engagement in the borrowing programme. It is a challenging instrument because it has risks as well. This is a risk the RBI has taken, keeping its commitment to give explicit guidance on liquidity.

Will the RBI not reject bids in future auctions if yields demanded by the market are higher than what the RBI is happy with?

Das: It will depend on whether the bids are orderly or otherwise. I cannot say we will completely give up the option of rejecting the bids. With the central bank managing so many conflicting objectives, we have to strike the right balance. It depends on whether the bids are orderly or an outlier.

No comments:

Post a Comment